Investment Management - First Quarter 2025

"What's Our Vector, Victor?"

Market direction is a simple concept to grasp, when the prevailing trend – rising or falling – is obvious and participation is broad. All trends exhaust themselves eventually, irrespective of timeframe. These pauses occur in all market environments, and are healthy, as they enable valuations to align with recent price action and moderate investor sentiment. Investors reference two major types, consolidations and corrections. Consolidations refer to periods of time characterized by major indices trading within a narrow price range while experiencing small price declines. Corrections, on the other hand, receive more attention due to the larger drawdowns in price while accompanied by spikes in volatility. Once completed, the prevailing trend generally resumes. This idea is part of a core tenant of technical analysis, though not all investors agree on its validity.

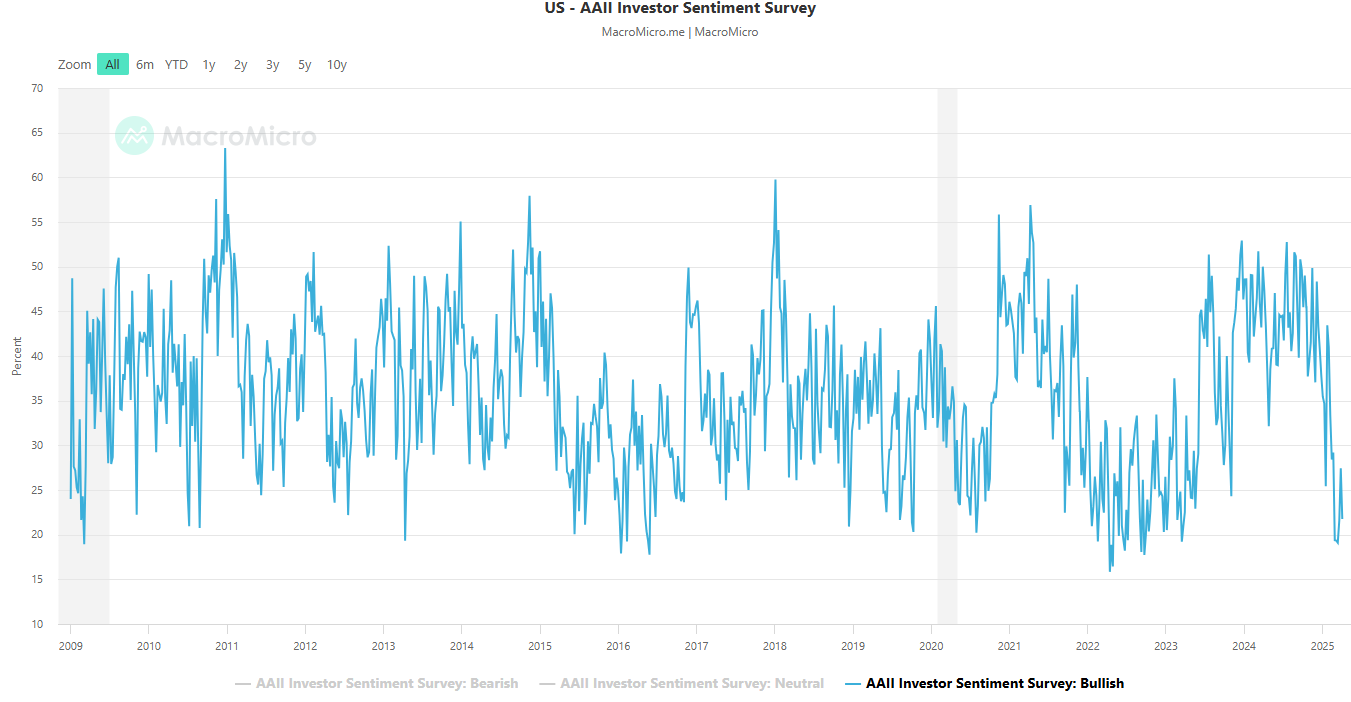

Entering 2025, following two years of robust equity market returns, history guides that investors should temper expectations for continued appreciation in the near term. Since the November 2024 election results were not contested, along with a resilient economic outlook, investor sentiment elevated quickly. The post-election euphoria faded as the new administration challenged Washington’s “business as usual” culture. The focus on trade protectionism, reducing federal spending, and immigration restrictions is expected to curtail economic growth in the short-term. However, the inconsistent messaging about specific policy initiatives makes it difficult to determine longer-term impacts. Growing uncertainty is not an endearing narrative for equity investors, illustrated by the dramatic decline of the American Association of Individual Investor’s sentiment survey, in which the percent of “bullish” investors fell from 49.8% on November 14th to 27.4% on March 27th.i

AAII Bullish sentiment!ii

With short-term visibility hampered, domestic stocks fell across the market capitalization spectrum. The large cap S&P 500 declined 4.27%, mid cap S&P 400 was down 6.10%, and the more economically sensitive small cap S&P 600 fell 8.93%. International stocks, tracked by the MSCI EAFE, jumped 6.86% over the past three months. That magnitude of relative outperformance between the MSCI EAFE and the S&P 500 has not been experienced since second quarter of 2002, almost 23 years!

Performanceiii for various indices for the three-month (not annualized), one-year, three-year, and five-year periods appears below:

Bond Indices

| Dates | ICE BofA 1-5 Yr. | ICE BofA 1-10 Yr. | ICE BofA 1-12 Yr. Muni |

|---|---|---|---|

| 12/31/24 - 3/31/25 | 1.98% | 2.30% | 0.51% |

| 3/31/24 - 3/31/25 | 6.47% | 6.49% | 2.11% |

| 3/31/22 - 3/31/25 | 3.74% | 3.17% | 2.02% |

| 3/31/20 - 3/31/25 | 2.92% | 2.78% | 1.28% |

Equity Indices

| Dates | Dow Jones Ind. Avg. | NASDAQ Composite | S&P 500 (Large) | S&P 400 (Medium) | S&P 600 (Small) | MSCI EAFE (Int'l) |

|---|---|---|---|---|---|---|

| 12/31/24 - 3/31/25 | -0.87% | -10.26% | -4.27% | -6.10% | -8.93% | 6.86% |

| 3/31/24 - 3/31/25 | 7.40% | 6.37% | 8.25% | -2.71% | -3.38% | 4.88% |

| 3/31/22 - 3/31/25 | 8.75% | 7.61% | 9.06% | 4.42% | 0.71% | 6.05% |

| 3/31/20 - 3/31/25 | 16.20% | 18.48% | 18.59% | 16.91% | 15.09% | 11.77% |

This jolt from international equities potentially reinvigorates an almost forgotten category of equity allocation. For perspective, the MSCI EAFE index, including last quarter’s outperformance, has underperformed the S&P 500 by over 6% per year, for the last 10 years. The U.S. economy has long been a driver of global economic growth, while other developed nations stagnated for a variety of reasons. These issues, whether self-inflicted or resulting from external geopolitical circumstances, led to diminished economic expectations among economists and investors. Over the last eight months, however, foreign countries began to embrace stimulative fiscal measures. China announced a series of initiatives to re-ignite their economy, though early policies were small and ignored domestic consumption.iv Last month, Germany did not make the same mistake, unveiling an unprecedented plan to boost fiscal spending.v,vi Though these more radical policy changes face political hurdles, the announcement itself delivered the “shock and awe” warranted to require an immediate reassessment of their outlook by market participants.

Domestically, investors experienced a different version of shock and awe, either in shock regarding the velocity of policy announcements and spending cuts or feeling awful given the haphazard methods used. It is widely believed the economy materially decelerated or potentially contracted during the first quarter.vii Note that growth during the first quarter is usually weaker, given the potential of winter weather to limit activity and the backwards-looking assessment of gross domestic product (GDP). However, the administration’s tariffs could also spark additional retaliation and significantly reduce exports, hurting manufacturing activity. One can utilize game theory to ponder all the potential outcomes or acknowledge that the U.S. is less reliant on exports than many other developed economies, and potentially in a better position for a prolonged standoff.

Currently, the economy appears resilient. The U.S. consumer remains in focus, particularly the rate of growth on consumption. While consumer sentiment surveys indicate a dour mood, they have little correlation with actual spending patterns. If unemployment and continuing jobless claims remain subdued, we expect the consumer to stay engaged. Offsetting those figures is slowing income growth, which is approximately 4% on a year-over-year basis. When income growth and inflation are similar rates, this generally indicates little or no rise of real income.

Investors are intently watching the decline in yield of the 10-year Treasury bond, which began the year at 4.57% and traded at 4.24% at quarter end. If the yield should equal approximately real GDP growth plus inflation, falling yields indicate expectations for economic growth are also declining, given the stickiness of recent inflation data. Before inflation became a persistent challenge, many investors believed the Federal Reserve (the Fed) would protect market participants against substantial losses. This implicit protection is referred to as “the Fed put.”

At its March meeting, the Federal Open Market Committee voted to keep rates unchanged, as broadly expected. The real story was a significant change to their description of the economy, reducing their growth projection for 2025 and increasing their inflation expectations. Broadly, the Fed discussed increased difficulty in forecasting, given uncertainties around tariff policies.viii Despite this uncertainty, latest dot plot continues to forecast two interest rate cuts in 2025, two in 2026, and one in 2027.

During Fed Chairman Powell’s post meeting press conference, transcripts show he used the word “uncertain” 18 times after opening with a statement that appeared to exude confidence. “My colleagues and I remain squarely focused on achieving our dual mandate goals of maximum employment and stable prices for the benefit of the American people. The economy is strong overall and has made significant progress toward our goals over the past two years. Labor market conditions are solid, and inflation has moved closer to our 2 percent longer-run goal, though it remains somewhat elevated.“ix

While we agree with Powell that there is considerable uncertainty in the current environment, we also believe that the Fed will not hesitate to act should data indicate economic conditions are materially worsening. Client portfolios are positioned to weather the storm, since we begin by building on a foundation of quality assets. In times of elevated volatility, the greatest opportunity cost could be liquidating near the low and not participating in a rebound. Inflation is another enemy since it destroys purchasing power. The most probable outcome for inflation will be slightly elevated levels over the next few years, while another 1970’s stagflation appears very unlikely.

At West Financial, our vector, or philosophy, is to focus on the long-term, diversifying across different asset classes and rebalancing when appropriate. Diversification limits volatility, while the goal of our security selection and manager due diligence is to achieve returns above our benchmark over a full business cycle. As a fiduciary for our clients, portfolio construction is one of the key components of our process, after discussions to identify and understand the individual needs and financial goals of every client. As with our clients, every storm that ripples through financial markets has certain distinct characteristics. Our objective is to guide through volatility and stay focused on achieving the goals that matter most to each client. As always, if there are changes to your situation or if you would like to reassess your risk tolerance, do not hesitate to contact a member of your West team to discuss your portfolio in more detail.

----------------------------------------------------------------------------------------------

We are delighted to introduce three exceptional additions to our team this quarter. Alan Menase joined West Financial as a relationship manager in March, bringing over a decade of advisory experience from leading financial institutions. Alan earned a BA in Psychology from the University of Delaware and is a Certified Financial PlannerTM Professional. Complementing our research capabilities, Leo Wilson was added as an equity analyst, arriving with an impressive background at a global trading and technology firm. Leo earned a BS in Finance from Saint Vincent College and an MS in Finance from Villanova University. Laura Suprock joined our internal compliance department as a compliance associate in February. Laura earned a BA in Japanese and a minor in Psychology from The Ohio State University and an MS in Applied Intelligence from Mercyhurst University. She is also a Certified Anti-Money Laundering Specialist (CAMS). Alan, Leo, and Laura represent our continued commitment to enhancing the expertise, depth, and client-focused approach that have been the hallmarks of our firm. Welcome Alan, Leo, and Laura!

We would like to congratulate Glen Buco, CFP®, and Victoria Henry, CFP®, for being named as Top Fee-Only Financial Advisors by Washingtonian magazine.x

Our annual disclosure documents, Form ADV Part 2A and Client Relationship Summary (Form CRS), have recently been filed with the Securities and Exchange Commission (SEC). As previously disclosed, Sandy Spring Bank merged with and into Atlantic Union Bank with Atlantic Union Bank acquiring a controlling interest in WFS. We have amended Form ADV Part 2A and Form CRS to disclose the change in ownership. In accordance with SEC regulations, in the event of any material change, we must provide to all clients our Form ADV Part 2A and Form CRS, or the Summary of Material Changes with an offer to provide the entire Form ADV Part 2A and Form CRS. The Summary of Material Changes can be found below. Form ADV Part 2A and Form CRS are available on our website (https://westfinancial.com/about-us/disclosures), the SEC’s website (www.adviserinfo.sec.gov), or can be provided to you in hardcopy form upon request.

Form ADV Part 2A – Summary of Material Changes

The following material changes have been made to WFS’s Form ADV brochure since the filing of the previous amendment on February 14, 2025:

- Item 2: Effective April 1, 2025, Sandy Spring Bank merged with and into Atlantic Union Bank and, in connection with this merger, Atlantic Union Bank acquired a controlling interest in WFS. Descriptions of WFS’s relationship with Atlantic Union Bank have been added.

- Item 10: Descriptions of WFS’s relationship with Atlantic Union Bank and its affiliates have been added.

Form CRS – Statement of Material Changes

The following material changes have been made to WFS’s Client Relationship Summary since the filing of the previous Client Relationship Summary on March 29, 2021:

- Item 5 – How do your financial professionals make money? Effective April 1, 2025, Sandy Spring Bank merged with and into Atlantic Union Bank and, in connection with this merger, Atlantic Union Bank acquired a controlling interest in WFS. Descriptions of WFS’s relationship with Atlantic Union Bank have been added.

Additionally, we have included our annual Privacy Notice, stating our policy on the confidentiality of client information. The material change that has been made to the Privacy Notice is the change of ownership from Sandy Spring Bank to Atlantic Union Bank as of April 1, 2025.

Our current Privacy Notice is also available on our website (https://westfinancial.com/about-us/disclosures). If you wish to opt out of sharing information, other than that which is required by law, please complete the form and mail it to our office or Sandy Spring Bank, a Division of Atlantic Union Bank, address provided on the form. If you prefer, you may also opt-out by calling the number listed on the Privacy Notice.

Thank you for your continued confidence in West Financial, and please do not hesitate to refer friends, family, or co-workers who you feel may benefit from our services.

|  |

|---|---|

President | Chief Investment Officer |

ihttps://www.aaii.com/sentimentsurvey/sent_results

iihttps://en.macromicro.me/charts/20828/us-aaii-sentimentsurvey

iiiEach of the S&P 500 Index, the S&P 400 Index, the S&P 600 Index, the MSCI EAFE Index, the ICE BofA 1-5 Year Index, the ICE BofA 1-10 Year Index, the ICE BofA 1-12 Year Municipal Bond Index, the Dow Jones Industrial Average, and the NASDAQ Composite (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance. The performance of an Index is not reflective of the performance of any specific investment. Each Index comparison is provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of your account and each Index may not be comparable. There may be significant differences between the characteristics of your account and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no adjustment for client additions or withdrawals, and no deduction for fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index.

ivhttps://www.cnbc.com/2025/01/16/china-stimulus-pans-as-economy-slows.html

vhttps://www.cnbc.com/2024/11/22/the-debt-brake-rule-that-helped-collapse-germanys-government.html

vihttps://www.schwab.com/learn/story/making-international-great-again

viihttps://www.atlantafed.org/cqer/research/gdpnow.aspx

viiihttps://www.federalreserve.gov/monetarypolicy/files/monetary20250319a1.pdf

xTo arrive at the names of the area’s top financial advisers—the fee-only financial planners, fee-based advisers, estate attorneys, tax accountants, and insurance advisers marked with a “Top Financial Advisor” tag—the Washingtonian distributed surveys to hundreds of people who work in the local financial industry, asking them whom they would trust with their own money. The Washingtonian also did their own research, consulting industry experts and publications. The “Top Financial Advisor” names on this list are the people who received the strongest recommendations. Firms do not pay a fee for employees to be considered or placed on the final list of “Top Fee-Only Financial Planners” or “best adviser.”

West Financial Services, Inc. (“WFS”) offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the firm has attained a particular level of skill or ability. You should carefully read and review all information provided by WFS, including Form ADV Part 1A, Part 2A brochure and all supplements, and Form CRS.

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security. You are solely responsible for reviewing the content and for any actions you take or choose not to take based on your review of such content.

This information is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own.

Certain information contained herein was derived from third party sources as indicated. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. WFS has not and will not independently verify this information. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to WFS.

Certain statements herein reflect projections or opinions of future financial or economic performance. Such statements are “forward-looking statements” based on various assumptions, which may not prove to be correct. No representation or warranty can be given that the projections, opinions, or assumptions will prove to be accurate.