Are You Expecting Too Much from Your Target Date Fund?

I always find it instructive when we ask clients a few questions to assess risk tolerance, something that is not an easy task given the emotions attached to investment dollars. One question is how much of a loss you would be willing to accept in a one-year period. A lot of people pick 0-5%, but some are more realistic and pick 15-20%. Historically, you would need to have an equity investment allocation of 50% or lower to avoid larger one-year losses. At the highest, this is a moderate allocation and may not be sufficient to meet longer-term needs for cash flow.

Further, we used to ask clients to rank different investment goals, including capital preservation, income, growth, etc. Enough clients picked both capital preservation and growth as top priorities (two things that don’t generally exist together at the same time) that we stopped asking for that insight. Of course, we all want the growth without the risk of losing principal. But circumstances demand that we balance the two goals.

How does this relate to target date funds, the most common default option in company-sponsored retirement plans? They promise a lot: professional money management, diversified portfolio, evolving asset allocation. What they deliver is not perfect, but really no investment will be able to satisfy every investor’s needs all at once.

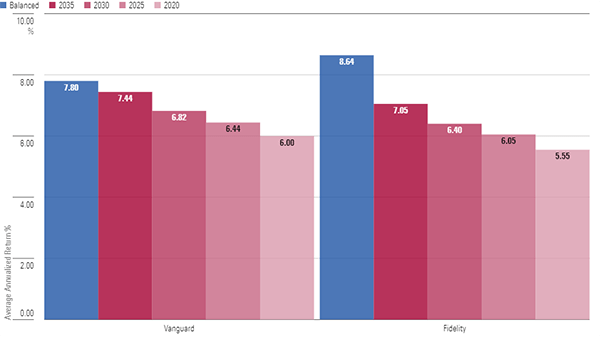

Earlier this year, John Rekenthaler, director of research for Morningstar Research Services, LLC, wrote an article comparing the performance of two top target date providers (Vanguard and Fidelity) to their balanced fund options. The analysis shows that both providers’ target date options underperformed the comparably allocated balanced fund over trailing periods of 5, 10 and 15 years due to an overweighting to foreign stocks. Rekenthaler’s conclusion was not to denigrate the fund managers for the international allocation, but to point out that these funds need to meet an institutional objective, which requires this level of global diversification. The paradox is that diversification may result in underperformance at times but is designed to mitigate losses in any one area of investment over time.

In his follow-up article, Rekenthaler highlights a recent court case in which the participants of a 401(k) plan sued the trustees for failing to fulfill their fiduciary duty to properly evaluate the plan’s target date funds against similar options regarding cost and performance. He provides some history into the plan’s choice of target date fund provider. Following a volatile year and disappointing 2008 performance, the plan’s investment committee decided to replace Fidelity as a provider with American Century. The thought behind the decision and the result was a steadier performing option. However, Fidelity’s higher equity allocation and growth bent has proven to be a clear winner over the past decade.

Which leads us to the observation again that no one investment, even a fully diversified one, will hit every mark during every market. Investors must be aware of components in their portfolio and how they are likely to add value over time. And more importantly how they may hold back returns. In short, you can’t effectively preserve assets and have outsized growth at the same time, all the time.

If you have any questions on how to allocate your retirement portfolio to provide that balance of risk versus return, please reach out to the financial planning team or your relationship manager.

Meet Kristan L. Anderson, CFP®, CEBS® »

Read the May 2024 Financial Planning Focus:

- “Long-Term Care” By Angel Irazola »

- “Tax Policy: The Next Political Battle” by Matt Cohen, CFP®, CIMA® »

- "Naming a 401K Beneficiary" by Kristan L. Anderson, CFP®, CEBS® »

SOURCES

Rekenthaler, J. (2023, August 3). Why The Biggest Target Date Funds Have Underperformed. Morningstar.

https://office.morningstar.com/research/doc/1171369/Why-the-Biggest-Target-Date-Funds-Have-Underperformed

Rekenthaler, J. (2023b, December 14). The Target Date Fund Problem That Indexing Can’t Solve. Morningstar.

https://office.morningstar.com/research/doc/1199213/The-Target-Date-Fund-Problem-That-Indexing-Can-t-Solve

IMPORTANT DISCLOSURES

West Financial Services, Inc. (“WFS”) offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the firm has attained a particular level of skill or ability. You should carefully read and review all information provided by WFS, including Form ADV Part 1A, Part 2A brochure and all supplements, and Form CRS.

Certain information contained herein was derived from third party sources, as indicated, and has not been independently verified. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to WFS

This information is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product, security, or concept. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. You should not treat these materials as advice in relation to legal, taxation, or investment matters. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisers.

Certain statements herein reflect projections or opinions of future financial or economic performance. Such statements are “forward-looking statements” based on various assumptions, which may not prove to be correct. No representation or warranty can be given that the projections, opinions, or assumptions will prove to be accurate.