Investment Management - Third Quarter 2019

We provide a copy of our investment management letter, without enclosures, to keep you up-to-date on the investment markets and West Financial Services.i

Do Treasuries Come in Pumpkin Spice Flavor?

A peculiar consumer preference this time of year is pumpkin spice. It’s in lattes, muffins, beer, and pretty much any food and drink product. Demand for it is strong, and thus companies have come to market with as many products as possible to meet our insatiable appetite for everything pumpkin spice. U.S. Treasuries might be the pumpkin spice equivalent investment in today’s market.

The demand for U.S. Treasuries, along with the synchronized decline in long-term sovereign bond yields, is one of the major stories of 2019, and the third quarter in particular. In September, the 10-year Treasury fell to a multi-year low of 1.43% compared to 3.2% at the end of 2018. Meanwhile, a 10-year German bund is yielding negative 58 basis points, and that is only the tip of the iceberg of $17 trillion in negative-yielding debt around the world. The feedback loop is that, despite the paltry yield on a 10-year U.S. Treasury, there remains strong demand for fixed income.

Driving yields lower is a confluence of geopolitical events, low inflation and central bank policies. In addition, a constant bombardment of headlines, tweets, and weak economic releases are putting pressure on investor sentiment and increasing risk aversion. At the end of the day, it’s about economic growth and that too is being weighed down by these very same factors.

During the quarter, equity markets were volatile, though they finished roughly in-line with where they started. The total return for the large capitalization S&P 500 was 1.70%. Mid and small capitalization stocks, tracked by the S&P 400 and S&P 600 indices, fell slightly, 0.09% and 0.20%, respectively. International equities, tracked by the MSCI EAFE, fell 1.07%, partially hurt by a stronger U.S. dollar.

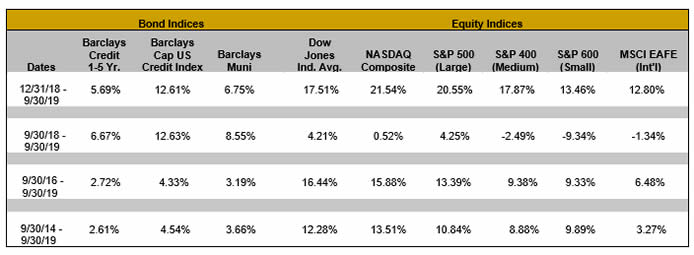

Performance provided by Morningstar for various indices for the year-to-date (not annualized), one-year, three-year, and five-year periods appears below:

Despite the slowdown, we continue to remain cautiously optimistic in our outlook for the domestic economy. The U.S. consumer remains the driving force behind growth, backed by solid employment data and rising wages. In stark contrast to the last expansion, the average consumer has not utilized excessive debt to drive consumption. With debt servicing requirements low, consumer spending should remain resilient. Other data points offer a more subdued picture. October’s ISM Non-Manufacturing Index tumbled to its lowest level in over three years, though still in expansion territory.

Globally, tariffs and trade skirmishes are impacting economic growth. The effect can be seen in trade data, in addition to the contraction of manufacturing activity around the world. Manufacturing also went through a contraction in 2015, but that did not derail what is now the longest economic expansion in U.S. history. Progress in the U.S. trade dispute with China would help alleviate some of this overhang. It would be especially helpful since a number of international economies are more dependent on exports than the United States.

Another reason for our constructive outlook is that central banks around the globe have re-engaged and are providing monetary policy support through lower interest rates and, at least in Europe and Japan, asset purchases. The Federal Open Market Committee (FOMC) reduced the fed funds rate in September by 25 basis points, the second interest rate reduction this year. Odds are favoring at least one more decrease before year-end.

For client portfolios, we continue to keep equity allocations close to target. At times, the S&P 500 was up as much as 20% from the beginning of the year, and it was advantageous to reduce allocations at those times. In fixed income, we are staying the current course of keeping our bond ladders fairly short-to-intermediate, while looking for opportunities. Maturities out to 2025 will bring yields in the range of 2.1% - 2.8% for investment grade corporate bonds. The municipal bond market continues to be elusive with very low yields and sky high prices.

Since West Financial Services’ inception, 37 years ago, we have focused on buying individual bonds for our clients. Through difficult times in the economy, the bonds generally provide greater stability to the portfolios and, in good times, they increase income. Recently, the bonds in client portfolios are generally benefitting from the increase in market prices, delivering good total returns for the fixed income allocation.

WFS held our annual client event on September 19th. We had a fun-filled evening with entertainment by The Fabulous Hubcaps and a full dance floor, costumes and all!

Kristan Anderson, Glen Buco, and Kim Cox were named to the Northern Virginia magazine’s Top Financial Professionals listing which was featured in the September 2019 issue.ii This is the ninth consecutive year we have been included in this list and we are honored to be recognized by our peers.

We would like to welcome our newest employees. Rick Gibson, CFP®, has joined our financial planning department. Rick is a graduate of Virginia Tech and has been providing comprehensive financial planning and customer service since 2013. We anticipate that his previous experience working at Northwestern Mutual will help build out our personal insurance knowledge for planning clients. Kunal Thakur is our new assistant information systems administrator. Kunal is a recent graduate of George Mason University and held two separate internships with Navy Federal Credit Union (NFCU) while attending college. While interning with NFCU, he was responsible for hardware and software support along with procedural documentation and training.

The WFS app is now available on the Apple App Store and on Google Play Store for both your smart phone and tablet! Instantly check your portfolio value, view recent activity and access important documents, including your quarterly statements and any other documents shared between you and your service team through the WFS client portal. Soon we will have instructional videos available for those new to using the client portal.

Continuing our initiative to Go Green, we strive to conduct as many of your account servicing requests via e-Signature as possible. In conjunction with your account custodian (Schwab, Fidelity, Pershing, etc.), our client service associates continue to build upon the availability of e-Signature with requests such as money movement, beneficiary updates, transfers, account openings, address changes and more! If you would like to learn more about the WFS app, e-Signature process, or need assistance gaining access, please contact your client service associate.

As we enter the final quarter of the year, please contact us should you have any questions or issues regarding your year-end tax planning and/or gifting needs. We are compiling year-end capital gain estimates from the mutual funds we invest in on your behalf, and will be happy to provide this information to you and/or your accountant upon request. You should be receiving statements directly from your account custodian at least quarterly. If you are not receiving your statements, please contact us.

We have provided performance reports for the year-to-date, one-year, three-year and five-year periods, where applicable. Should you have any questions regarding your portfolio, or any financial planning related questions, please call us at any time. Thank you for your continued confidence in us and please do not hesitate to refer friends, family or co-workers who you feel may benefit from our services. If you are scheduled to have a meeting in our office, don’t forget to ask for pumpkin spice coffee.

|

President

|

Chief Investment Officer

|

Director of Fixed Income

|

|---|---|---|

|

|

|

| Glen J. Buco, CFP® | Glenn Robinson, CFA | Norma Graves, CFP® |

West Financial Services, Inc. offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the firm has attained a particular level of skill or ability. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security. You are solely responsible for reviewing the content and for any actions you take or choose not to take based on your review of such content.

Certain information contained herein was derived from third party sources as indicated. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. We have not and will not independently verify this information. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to West Financial Services, Inc.

Certain statements herein reflect projections or opinions of future financial or economic performance. Such statements are “forward-looking statements” based on various assumptions, which may not prove to be correct. No representation or warranty can be given that the projections, opinions, or assumptions will prove to be accurate.

iThe S&P 500 Index, the S&P 400 Index, the S&P 600 Index, the MSCI EAFE Index, the Barclays Credit 1-5 Year Index, the Barclays Cap U.S. Credit Index, the Dow Jones Industrial Average, and the NASDAQ Composite (each an “index”) are unmanaged indices of securities that are used as general measures of market performance. The performance of an index is not reflective of the performance of any specific investment. Each index comparison is provided for informational purposes only. Further, the performance of your account and each index may not be comparable. There may be significant differences between the characteristics of your account and each index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each index reflects no adjustment for client additions or withdrawals, and no deductions for fees or expenses. Accordingly, comparisons against the index may be of limited use. Investments cannot be made directly into an index.

iiTo compile the Top Financial Professionals list, Northern Virginia Magazine enlisted input from the Certified Financial Planner Board of Standards, Inc. (the “CFP Board”) which grants and upholds the CFP® designation as a recognized standard of excellence in personal financial planning. Using data provided by the CFP Board, Northern Virginia Magazine asked CFP® certificants and other finance professionals in Northern Virginia to nominate peers. The “Top Financial Professional” listing is given to those financial advisors that receive the most nominations. Financial professionals do not pay a fee to be included.