Special Release - Sector Reshuffling

Communication Breakdown1

Major changes are happening to the sector classifications that companies are assigned to within key U.S. stock indices, and we wanted to alert you to these changes. These changes occurred on September 21st, and will be reflected on your Q3 2018 reports.

For background, the S&P categorizes companies within 11 sectors; consumer staples, energy, technology, etc. The categorization is formally known as the Global Industry Classification Standard (GICS). Classification changes happen from time to time, the most recent being the addition of a real estate sector in 2016, which removed real estate investment trusts (REITs) from the financials sector.

Most historical changes to the GICS structure have been relatively modest – similar to the real estate change. What was announced in 2017, and effective as of September 21, 2018, is the largest classification change in history, with the re-classification of 10% of the market cap of the S&P 500.2 The telecommunications sector – the historical home to Verizon and AT&T – is being renamed to Communications Services. This change is in recognition of industry consolidation and integration among telecommunications, media and internet companies. For example, media and technology services companies such as Disney and Facebook have been reclassified to this new sector. This has raised a few questions.

Why is this change being made?

The internet has transformed how we communicate with one another, and technology has transformed how we consume products and entertainment. Is Alphabet, Google’s parent company, a technology firm? What is their product? They derive the vast majority of their revenue from advertising dollars, and those companies advertising on Google’s platform want to capture the attention of people using Google’s email service, internet search, streaming videos on YouTube, etc. Google’s use of “technology” is a means of connecting their customers with each other and to advertisers, similar to how copper wires and telephone poles were a means to how landline businesses connected their customers (and telemarketers) in the past. The new GICS structure acknowledges the changing landscape in how we communicate and consume information and entertainment.

What is the investment impact to my portfolio?

At a high level, the changes being made are akin to shuffling a deck of cards; the same 52 cards are in the deck. West Financial’s stock portfolios will continue to have exposure to all the S&P sectors after this change, and we won’t be buying or selling a stock simply because of a sector reclassification. It’s important to remember we select companies based on their own fundamentals; Google isn’t going to change its business model because investors classify the stock differently. Sector mutual funds and exchange traded funds (ETFs) have been preparing for this change. Any stock price dislocation due to the portfolio changes they need to make is expected to be short-lived.

What is the impact on West Financial’s Reporting and Investor Portal Views?

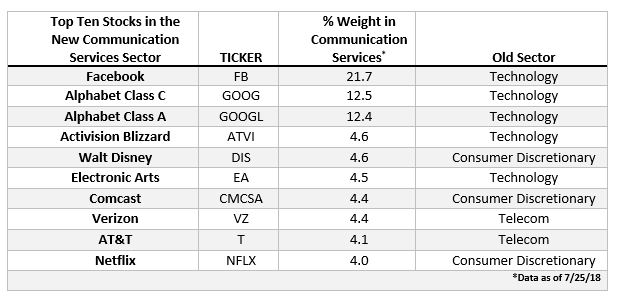

Starting on September 24th, the investor portal will reflect the new sector classifications. A summary of the companies being reclassified are below. The 3rd quarter West Financial report will also include these changes.

With such a large change to well-known companies, we want to keep you apprised of how this will impact your accounts. If you have any questions, please don’t hesitate to contact your relationship team.

1Disclosures:

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. West Financial can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

2State Street Global Advisors, https://us.spdrs.com/docs-commentary/gics-sector-structure-changes.pdf