Investment Management - Fourth Quarter 2019

We provide a copy of our investment management letter, without enclosures, to keep you up-to-date on the investment markets and West Financial Services.i

Pop the champagne and please excuse investors for feeling jubilant. After all, it has been quite a turn of events since one year ago. In 2019, the S&P 500 soared 31.5%, leading a global rally in stocks and bonds. A combination of central bank activity, positive news on trade, and indications that global manufacturing activity had begun to stabilize, were behind the move. In fairness, the substantial gains were actually a result of the stock market correction during the fourth quarter of 2018. From the September 2018 highs, the index is only up approximately 10%.

Not many people put a lot of faith in this rally, or the expansion cycle in general. While economic growth hasn’t been stellar, it has been durable, averaging around 2% annually. According to Bianco Research, for the first time since the signing of the Declaration of Independence in 1776, the U.S. completed a calendar decade without even one day of a recession. Despite this historical good news, critics point to central bank intervention, among other reasons, to declare this cycle counterfeit.

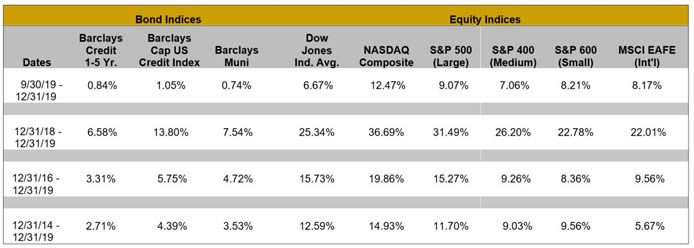

Reviewing equity performance, large cap stocks, particularly growth-oriented sectors such as technology, have been the market leaders this cycle, a trend which continued over the final three months. During the quarter, the total return for the S&P 500 Index was a robust 9.1% while the technology sector rose 14.4%. The mid cap S&P 400 Index and small cap S&P 600 Index rose 7.1% and 8.2%, respectively. International stocks, tracked by the MSCI EAFE, rose 8.2% thanks in part to a declining U.S. dollar.

Performance for various indices for the three-month (not annualized), one-year, three-year and five-year periods appears below:

Looking ahead, the scenario for 2020 is significantly different than one year ago, when a number of strategists were calling for a recession. Economists now expect the rate of growth to accelerate modestly, as sentiment improves on positive news regarding trade. The U.S. and China are expected to sign a smaller phase one deal - one that will reduce tariffs while expanding agricultural exports from the U.S. Meanwhile, central banks around the world are reducing interest rates while continuing to expand their balance sheets via asset purchases.

In October, the Federal Open Market Committee (FOMC) cut the fed funds rate for the third time in 2019, bringing the rate down to a range of 1.5%-1.75%. During his press conference after the December meeting, Fed Chairman Jerome Powell signaled the Fed would stand pat for 2020 unless the economy weakened significantly. The new president of the European Central Bank, Christine Lagarde, has called on governments with budget surpluses to initiate fiscal spending to help spur economic growth, while Japan announced their own stimulus package of $239 billion over the next few years.

Improved sentiment can also be observed in the global bond market. The amount of negative yielding bonds has fallen to $11 trillion from $17 trillion since August. Also, the U.S. Treasury yield curve is no longer inverted, as the yield on longer-term 10-year Treasury bonds has risen back above the yield of shorter-term 2-year instruments.

Our outlook remains positive based on the strength of the job market and the U.S. consumer. In November, the Department of Labor reported the unemployment rate once again fell to 3.5%, which matches September’s figure and matches the lowest level since 1969. Wages grew 3.1% from a year ago, while higher minimum wage mandates are providing an enormous boost to low wage earners. Consumers continue to spend, with holiday spending up 3.4% over last year. Another area gaining strength is the housing market, which was definitely helped by lower interest rates. New home sales in November hit an annual rate of 719,000, an increase of 19.4% year-over-year. Inflation is tame, which allows the Fed to remain on the sidelines.

More importantly, there are fewer economic yellow flags at the moment. The largest risk comes from the geopolitical sphere, as recent tensions with Iran demonstrate. The current crisis has knocked the trade war with China out of the headlines, but note that negotiations regarding intellectual property theft and access to the Chinese market are still to come.

We maintain our bias for equities over fixed income in our managed portfolios. In 2020, earnings-per-share (EPS) for the S&P 500 Index is expected to increase 10% thanks in part to an acceleration in economic growth. Corporations continue to repurchase stock, which will help offset slightly lower operating margins. That being said, equities closed out 2019 at valuations that are approaching the higher-end of the 20-year range. We must remain disciplined and continue to trim equity positions into market strength. For fixed income, our bond-ladder strategy remains to buy maturities out to five years while being opportunistic when confronted with short-term interest rate changes or higher yielding bonds with improving fundamentals.

The women of West Financial were featured in the October 2019 issue of Washingtonian magazine. Please see our ad by clicking the link on the home page of our website.

Congratulations to the following: our relationship manager, Angela Baker, for earning her Retirement Income Certified Professional (RICP®) designation, Kim Cox and Brian Mackin for being recognized as a “Five Star Wealth Manager”ii by Five Star Professional in October 2019, and Glen Buco, Kim Cox, and Victoria Henry for being nominated by their peers and ultimately named as Top Fee-Only Financial Planners in the December 2019 issue of Washingtonian magazine.iii

We are always striving to improve our service and, in order to do so, we need your feedback. A link to our client survey was sent through Constant Contact in December. We thank you for your participation and input. In January, we sent a reminder email for those of you who have not yet responded. If for any reason you have not received it, please contact our office.

If you missed it in our last letter, the WFS app is now available on the Apple App Store and on Google Play Store for both your smart phone and tablet! Instantly check your portfolio value, view recent activity and access important documents, including your quarterly statements and any other documents shared between you and your service team through the WFS client portal. Instructional videos are now available on the Client Center page on our website for those new to using the client portal.

Enclosed you will find your portfolio appraisal as of December 31, 2019. We have provided performance numbers for the quarter, one-year, three-year and five-year periods, where appropriate. The custodian where your account is held will be sending Form 1099-DIV (dividends) and 1099-INT (interest) information to you directly. Also, the Form 1099-B will provide a record of realized gains and/or losses in taxable account(s) as well as any management fees paid directly from your brokerage account(s).

As West Financial Services enters its 38th year, now with 37 employees, we would like to thank you for recommending our firm and your continued confidence in our investment management and financial planning services. We wish all of you and your families a happy, safe, and prosperous 2020. Should you have any questions regarding your portfolio or financial plans, please do not hesitate to contact us at any time.

|

President

|

Chief Investment Officer

|

Director of Fixed Income

|

|---|---|---|

|

|

|

| Glen J. Buco, CFP® | Glenn Robinson, CFA | Norma Graves, CFP® |

iWest Financial Services, Inc. offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the firm has attained a particular level of skill or ability. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security. You are solely responsible for reviewing the content and for any actions you take or choose not to take based on your review of such content.

Information contained herein was derived from third party sources as indicated. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. We have not and will not independently verify this information. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to West Financial Services, Inc.

The S&P 500 Index, the S&P 400 Index, the S&P 600 Index, the MSCI EAFE Index, the Barclays Credit 1-5 Year Index, the Barclays Cap U.S. Credit Index, the Dow Jones Industrial Average, and the NASDAQ Composite (each, an “Index”) is an unmanaged index of common stocks that is used as a general measure of security market performance, and its performance is not reflective of the performance of any specific investment. The Index comparisons are provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of your account and each Index may not be comparable. There may be significant differences between your account and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no deduction for client withdrawals, fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index.

iiThe Five Star Professional award program, managed by fivestarprofessional.com, conducts market-specific research throughout the U.S. and Canada to select reputable, specialized, and honest service professionals. Required eligibility criteria: (1) Credentialed as an investment advisory representative or a registered investment advisor; (2) Actively employed as a credentialed professional in the financial services industry for a minimum of five years; (3) Favorable regulatory and compliant history review; (4) Fulfilled their firm review based on internal firm standards; and (5) Accepting new clients. Considered eligibility criteria: (1) One-year client retention rate; (2) Five-year client retention rate; (3) Non-institutional discretionary and/or non-discretionary client assets administered; (4) Number of client households served; and (5) Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers.

iiiTo arrive at the names of the area’s top financial advisers—the fee-only financial planners, fee-based advisers, estate attorneys, tax accountants, and insurance advisers marked with a “best adviser” tag—the Washingtonian distributed surveys to hundreds of people who work in the local financial industry, asking them whom they would trust with their own money. Washingtonian also did their own research, consulting industry experts and publications. The “best adviser” names on this list are the people who received the strongest recommendations. Most of the “best advisers” are at smaller, independent firms. The surveying process does not turn up as many names at large banks and brokerages. One reason is that banks and brokerages sometimes keep more work in-house—and if a financial adviser isn’t referring clients to outside professionals, that adviser might not have a network that earns peer votes.