Investment Management - First Quarter 2022

Stop the Madness!

Please do not be alarmed! West Financial is not calling for an end to the NCAA basketball tournaments, despite the fact it would save us from time spent on bracket predictions that are busted the first weekend. Rather, it’s the continuing madness of trying to forecast economic data, interest rates and inflation, in an unpredictable and dynamic environment.

There is discontinuous and rapid change in globalization, aggregate demand, technology and regulation. One must construct a portfolio carefully to avoid the ditches on both sides of the road. Unfortunately, just like a buzzer-beating shot, there are no do-overs.

With uncertainty being the theme of the moment, what data to watch? To quote popular economist, Ed Yardeni, the outcome of a number of today’s concerns are what he calls “known unknowns.” Will the Federal Reserve (the Fed) fall victim to the tidal wave of criticism and drive the economy into a recession to stomp out inflation? Will base effects that helped to drive inflation to 40-year highs roll-off soon? Will supply chains still be hampered in the second half of the year? Finally, will real wage growth (nominal increase in wages after subtracting the rate of inflation) continue?

This elevated level of ambiguity crushed investor sentiment, which made the first quarter difficult for risk assets. The total return for the S&P 500 was negative 4.60%. Mid and small capitalization stocks, tracked by the S&P 400 and S&P 600, fell 4.88% and 5.62%, respectively. International stocks experienced dual headwinds, mainly due to Russia’s invasion of Ukraine. During times of crisis, investors flock to safe havens, which drove the U.S. dollar higher over the last three months.

Performancei for various indices for the three-month (not annualized), one-year, three-year, and five-year periods appears below:

Bond Indices

| Dates | Bloomberg Credit 1-5 Yr. | Bloomberg US Credit | Bloomberg Muni |

|---|---|---|---|

| 12/31/21- 3/31/22 | -3.65% | -7.42% | -6.23% |

| 3/31/21 - 3/31/22 | -3.63% | -4.16% | -4.47% |

| 3/31/19 - 3/31/22 | 1.61% | 2.81% | 1.53% |

| 3/31/17 - 3/31/22 | 1.95% | 3.18% | 2.52% |

Equity Indices

| Dates | Dow Jones Ind. Avg. | NASDAQ Composite | S&P 500 (Large) | S&P 400 (Medium) | S&P 600 (Small) | MSCI EAFE (Int'l) |

|---|---|---|---|---|---|---|

| 12/31/21- 3/31/22 | -4.10% | -8.95% | -4.60% | -4.88% | -5.62% | -5.91% |

| 3/31/21 - 3/31/22 | 7.11% | 8.06% | 15.65% | 4.59% | 1.23% | 1.16% |

| 3/31/19 - 3/31/22 | 12.57% | 23.57% | 18.92% | 14.14% | 13.58% | 7.78% |

| 3/31/17 - 3/31/22 | 13.40% | 20.31% | 15.99% | 11.10% | 10.89% | 6.72% |

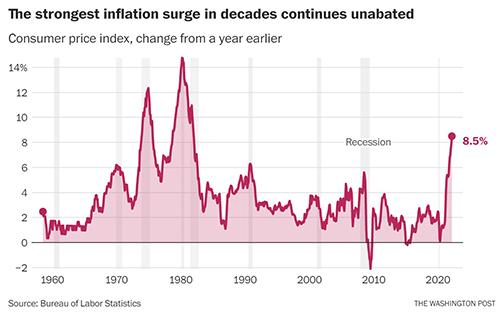

One of the major topics discussed in our Investment Committee meetings over the past year has been the subject of inflation. Inflation data is at levels not seen in over 40 years, 8.5% at last print. The cause was exceptionally strong demand for material goods, such as computers and cars, while the pandemic wreaked havoc on global supply chains. Recently, a number of investment strategists have mentioned the comparison to stagflation. As a reminder, stagflation was the dreaded scenario that haunted the U.S. in the late 1970s, characterized by high inflation, high unemployment and weak or no economic growth.ii

Consumer Price Index Chartiii

Although we are experiencing extremely high inflation, the U.S. employment figures are strong, with the unemployment level at just 3.6%.iv Supply chain issues, one of the main culprits of reported inflation numbers, should ease as pandemic concerns fall and demand for goods decelerates. Prior to the war in Ukraine, inflation was expected to peak in February, but now that has been pushed out by a few months with experienced inflation hovering in the 8%-9% range.v In addition, the year-over-year comparisons should become increasingly favorable over the summer, which will naturally lower inflation into the 4-5% range by year-end. The Fed is also doing their part to tame inflation by increasing interest rates to lower demand.

In March, the Fed began its tightening cycle by raising the federal funds rate to 0.25% from 0%, the first increase since December 2018. They plan an aggressive path of increasing rates, possibly at each of the next six meetings in 2022. As of this writing, the ten-year U.S. treasury is yielding 2.72%, the highest since January 2019 and higher by 106 basis points in one year.vi On the other hand, the two-year treasury is yielding 2.41%, up 224 basis points for the year. Briefly the two-year yield was higher than the ten-year yield, known as yield curve inversion.vii Historically, going back to 1956, an inverted yield curve has predicted every recession with the average length of time between the initial inversion and the beginning of a recession being approximately 18 months.viii However, there have been instances when the yield curve inverts though no recession follows.

Many strategists and investors believe the Fed is behind the curve in hiking rates.ix This concern increases the probability of a policy mistake, or increasing the fed funds rate too much, too soon. This will likely hamper growth and may put the U.S. economy into a recession. Federal Open Market Committee (FOMC) members chart their “dot plot” every three months to give a hint of where they believe the key fed funds rate will be at the end of each year, three years into the future.x Although Fed Chairman Powell has emphasized the dot plot is not a forecast, many read a lot into the chart, especially where there are groupings of dots. A year ago in June, the dot plot illustrated that a majority of Fed members only saw one 25 basis point hike in 2022.xi Even by December, the plot was favoring only three rate hikes in 2022.xii In just 3 months’ time, the number has more than doubled to possibly seven rate hikes with possibly 50 vs. 25 basis point moves. No pun intended, is the Fed behind the curve? In trying to control inflation, the Fed’s goal is to smooth out the glide path of interest rate increases, to engineer a soft landing and avoid a recession.

Unfortunately, rising interest rates also impact the current price for many bond holdings. West Financial has long championed individual securities since, if held to maturity, the principal will be paid back in full. An advantage of holding a bond ladder is having monies come due to reinvest at higher rates, as we are seeing today. Maturities and called bonds, of which we have many, are being reinvested with yields we have not seen in years. To that end, we are also seeing municipal bonds become attractive purchases for those with high tax rates. As we are in the midst of tax season, please be sure to speak with your relationship manager and update your current tax rate or upload your return into the WFS portal. It is extremely helpful in making informed decisions regarding your portfolio.

In our equity portfolios, we have maintained a bias towards secular growth themes. While the mutual funds and stocks contain exposure to more economically-sensitive areas, the relative lower exposure has hurt performance in the short-term. We are balancing current weights and exposures with the tax consequences of realizing gains. As always, high quality positions are core to our strategy. These companies are not Cinderella stories, but blue-chip stocks that have an ability to grow their earnings and dividend payouts. As for the tournament, congratulations to the Jayhawks and South Carolina for winning the men’s and women’s tournaments, respectively. For investors, volatility is likely to remain elevated in the short-term. If there is one known-known, it is that we are not in Kansas anymore!

-------------------------------------------------

Over the last 40 years, WFS has managed assets for generations within families. But did you know that we also serve businesses, nonprofits and executives as well? As a full service registered investment advisor, WFS serves as a co-fiduciary for our institutional clients. Kristan Anderson, CFP®, CEBS® has headed up our retirement plan consulting business for more than 25 years. Kristan’s primary responsibility is the development and delivery of consulting services for fiduciaries of 401(k) and related retirement plans. On the asset management side, WFS manages investments for nonprofits and businesses, large and small. WFS has decades of experience helping executives and their families with legacy/philanthropic planning, multi-generational strategies, business entity planning, assistance with purchasing capital assets and much more.

We would like to congratulate Glen Buco, Brian Mackin, and Victoria Grossmann Henry for their recognition as Top Fee-Only Financial Planners by Washingtonian magazine in March. To arrive at the names of the area’s top financial advisers — the fee-only financial planners, fee-based advisers, estate attorneys, tax accountants, and insurance advisers marked with a “best adviser” tag — the Washingtonian distributed surveys to hundreds of people who work in the local financial industry, asking them whom they would trust with their own money. Washingtonian also did their own research, consulting industry experts and publications. The “best adviser” names on this list are the people who received the strongest recommendations. Firms do not pay a fee for employees to be considered or placed on the final list of “Top Fee-Only Financial Planners” or “best adviser.” Also in March, we were pleased to host Bradford Pineault, CFA, Vice President of Capital Market Strategy at Fidelity Investments for a fireside chat with our own CIO, Glenn Robinson, CFA.

Sadly, we bid a fond farewell to our Chief Operating Officer and Relationship Manager, Kim Cox. After 24 years with West Financial, Kim has decided to follow the advice she has given numerous clients over the years and retire. We will miss Kim and wish her nothing but good health and happiness as she begins the next chapter of her amazing story!

Our annual disclosure documents, Client Relationship Summary (“Form CRS”) and Form ADV Part 2A, have recently been filed with the SEC. There have been no material changes made to our Form ADV Part 2A and Form CRS since the filing of the previous amendment on March 29, 2021. Our current Form CRS and Form ADV Part 2A are available on our website, the SEC’s website, or can be provided to you in hard copy form upon request.

We have provided performance numbers for the quarter, one-year, three-year and five-year periods where appropriate. Should you have any questions regarding your portfolio, or any financial planning related questions, please call us at any time. Also, please contact your relationship team if your risk tolerance or time horizon has changed, to ensure your allocation remains appropriate. Thank you for your continued confidence in West Financial and please do not hesitate to refer friends, family or co-workers who you feel may benefit from our services. In our 40th year of service, we remain committed to putting our clients first, providing honest communication and transparency, and to ensure proactive, accessible, and flexible service. Don’t hesitate to let us know how we are doing and ways in which we can improve.

President | Chief Investment Officer | Director of Fixed Income |

|---|---|---|

|  |  |

| Glen J. Buco, CFP® | Glenn Robinson, CFA | Norma Graves, CFP® |

iEach of the S&P 500 Index, the S&P 400 Index, the S&P 600 Index, the MSCI EAFE Index, the Barclays Credit 1-5 Year Index, the Barclays Cap U.S. Credit Index, the Barclays Capital Municipal Bond Index, the Dow Jones Industrial Average, and the NASDAQ Composite (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance. The performance of an Index is not reflective of the performance of any specific investment. Each Index comparison is provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of your account and each Index may not be comparable. There may be significant differences between the characteristics of your account and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no adjustment for client additions or withdrawals, and no deduction for fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index.

iihttps://www.investopedia.com/articles/economics/08/1970-stagflation.asp.

iiiCPI Graph: https://www.washingtonpost.com/business/2022/04/12/inflation-march-cpi/.

vihttps://www.cnbc.com/2022/04/05/us-bonds-treasury-yields-rise-and-remain-inverted.html.

viihttps://www.cnbc.com/2022/04/05/us-bonds-treasury-yields-rise-and-remain-inverted.html.

ixhttps://www.cnbc.com/2022/03/16/federal-reserve-meeting.html.

West Financial Services, Inc. (“WFS”) offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the firm has attained a particular level of skill or ability. You should carefully read and review all information provided by WFS, including Form ADV Part 1A, Part 2A brochure and all supplements, and Form CRS. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security. You are solely responsible for reviewing the content and for any actions you take or choose not to take based on your review of such content.

This information is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Certain information contained herein was derived from third party sources as indicated. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. WFS has not and will not independently verify this information. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to WFS.

Certain statements herein reflect projections or opinions of future financial or economic performance. Such statements are “forward-looking statements” based on various assumptions, which may not prove to be correct. No representation or warranty can be given that the projections, opinions, or assumptions will prove to be accurate.