Investment Management - First Quarter 2020

We provide a copy of our investment management letter, without enclosures, to keep you up-to-date on the investment markets and West Financial Services.i

Welcome to Social Distancing!

“Everyone has a plan until they get punched in the mouth.” – Mike Tyson

Stepping into 2020, investors were confident they were confronting an improved economic scenario. The outlook for a trade deal with China improved dramatically, while the Federal Reserve lowered interest rates to sustain growth. Instead, investors were hit with a one-two punch of the COVID-19 pandemic and crashing oil prices, which ends the longest period of economic expansion in U.S. history.

In response to the global pandemic, governments pushed to contain the outbreak by urging citizens to self-quarantine in an attempt to “flatten the curve.” Asking people to stay home in a service-based economy was essentially a knockout punch to growth.

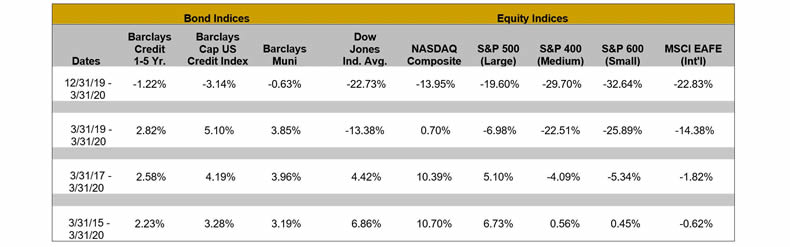

For the first quarter of 2020, the total return for the large capitalization S&P 500 was -19.6%. Mid and small capitalization indices performed worse, falling 29.7% and 32.6%, respectively. International equities, tracked by the MSCI EAFE, fell 22.8%.

Performance for various indices for the three-month (not annualized), one-year, three-year and five-year periods appears below:

Fixed income markets also experienced dislocation during the quarter. Record outflows from bond funds and exchange-traded funds (ETFs) caused a liquidity crisis similar to the one faced during the 2008 financial crisis. The impact affected prices across the fixed income landscape, including corporate and municipal bonds. And the corresponding flight to safety drove the yield on the 10-year Treasury down from 1.88% at the start of the year to 0.60%.

In March, the 10-year Treasury yield hit an all-time low of 0.318% right after the Federal Open Market Committee (FOMC) lowered the fed funds rate by 0.50%, the first intra-meeting rate cut since the financial crisis. At the scheduled FOMC meeting on March 15th, rates again were lowered to effectively 0%.

As March wound down, these initial steps from the Federal Reserve seemed to have little impact on the economy. That is when the FOMC brought out the big guns. To support critical market functioning, the FOMC announced that it would purchase Treasury and agency mortgage-backed securities, “in the amounts needed to support smooth market functioning.” This “all in” effort slowly brought liquidity back to the fixed income market.

In addition to the monetary stimulus actions, Congress passed, and President Trump signed, the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act. This package of fiscal stimulus includes money paid directly to individuals, while also expanding jobless benefits and offering federally guaranteed loans to small businesses. That is the blow-by-blow description of the financial markets and the economy for the quarter.

Looking forward, while the U.S. economy is down, it’s definitely not out. At this moment, the contraction in gross domestic product (GDP) for the second quarter is likely to be deep. However, the duration of the contraction is still not certain. Pharmaceutical companies are working on treatments and vaccinations. There will likely be another stimulus package. And social distancing, stay-at-home, and the closure of schools and non-essential businesses are all in place. All basic, effective, and straight to the point measures.

At West Financial, our investment philosophy and processes take into account the individual circumstances of each of our clients. This relationship governs the actions that we take regarding investment allocation, diversification, security selection, and a wide range of issues, concerns, and planning needs. It is at times like this that we believe you need to be aware, prepared, and committed to the “plan” that you have in place. It is in times like this that we earn trust and build relationships that will endure over time. Our communication level has increased significantly due to the changes occurring daily and the circumstances which we all share. However, do not hesitate to contact a member of your team or our financial planning department if you have questions, would like to discuss the positioning of your accounts, review short-term needs, or your long-term projections in greater detail. Please contact us if your circumstances have changed so we can review your asset allocation in an effort to determine if it remains appropriate based on your risk tolerance and time horizon.

We would like to welcome our newest employee, Max Sabel. Max joined West Financial in February as a client service associate. Max has prior experience within client service, having worked for an investment advisory firm in Maryland prior to joining our firm.

In conjunction with our client portal, we continue to offer e-Signature services for most client requests, including new account opening, transfers, and money movement. If you would like to schedule a tutorial for the portal, or a demonstration of e-Signature, please contact your client service associate.

Also, our annual disclosure document, Form ADV Part 2A, has recently been filed with the SEC. In accordance with SEC regulations, in the event of any material change, we must provide to all clients our Form ADV Part 2A or the Summary of Material Changes of the Form ADV Part 2A, with an offer to provide the entire Form ADV Part 2A. The Summary of Material Changes of the Form ADV Part 2A can be found at the end of this page. Our current Form ADV Part 2A is available here, the SEC’s website (www.adviserinfo.sec.gov), or can be provided to you in hardcopy form upon request.

You are receiving by mail, email or the portal, your portfolio appraisal dated March 31, 2020. We have provided performance numbers for the quarter, one-year, three-year, and five-year periods, where appropriate. Should you have any questions regarding your portfolio, please call us at any time.

Thank you for your continued confidence in West Financial. Please do not hesitate to refer friends, family or co-workers who you feel may benefit from our services. We remain committed to putting our clients first, providing honest communication, and providing proactive, accessible, and flexible service. Welcome to social distancing! Let us know how we are performing on our commitment to you.

|

President

|

Chief Investment Officer

|

Director of Fixed Income

|

|---|---|---|

|

|

|

| Glen J. Buco, CFP® | Glenn Robinson, CFA | Norma Graves, CFP® |

West Financial Services, Inc. (“WFS”) offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the firm has attained a particular level of skill or ability. You should carefully read and review all information provided by WFS, including Form ADV Part 1A, Part 2A brochure and all supplements. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security. You are solely responsible for reviewing the content and for any actions you take or choose not to take based on your review of such content.

This information is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own.

Certain information contained herein was derived from third party sources, and has not been independently verified. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to WFS.

iEach of the S&P 500 Index, the S&P 400 Index, the S&P 600 Index, the MSCI EAFE Index, the Barclays Credit 1-5 Year Index, the Barclays Cap U.S. Credit Index, the Barclays Capital Municipal Bond Index, the Dow Jones Industrial Average, and the NASDAQ Composite (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance. The performance of an Index is not reflective of the performance of any specific investment. Each Index comparisons is provided for informational purposes only. Further, the performance of your account and each Index may not be comparable. There may be significant differences between the characteristics of your account and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no adjustment for client additions or withdrawals, and no deduction for fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index.

Item 2 Statement of Material Changes

On July 28, 2010, the SEC published “Amendments to Form ADV” which amends the disclosure document that advisers provide to clients as required by SEC rules. This Form ADV Part 2A brochure is a document which West Financial Services (“WFS”) provides to its clients as required by SEC rules.

The following material changes have been made to this brochure since the filing of the previous amendment on March 18, 2019:

- Item 4: Added a description of certain limited financial planning services offered by WFS.